What Days Does Wmr Update 2018

On my post roofing the IRS Refund Bike Schedule I saw a lot of comments around the refund processing condition' on the IRS' Where is My Refund (WMR) website or on the IRS2Go mobile app. Clearly there is a lot of confusion every bit people anxiously wait their refunds and are unclear of how the IRS was processing their returns.

In fact if you search revenue enhancement forums one of the most common questions are effectually differences between the 3 WMR status' which are Return Received, Refund (Return) Approved and Refund Sent.The tracker is updated daily (~3AM EST) so there is no need to constantly cheque it.

You tin can start using the WMR website or IRS2Go app to commencement checking on the condition of your return 24 hours after the IRS receives your eastward-filed return or 2 to 3 weeks after you mail a newspaper return.

As the IRS processes your return it will progress through the 3 stages and provide you information (IRS error codes) on your taxation refund processing and/or if you demand to take actions like providing more information or calling the IRS.

Here are more than details on each condition and what each one means:

WMR Status Bar 1: Render Received

This status is is the same as "Render Accepted past the IRS." This means that your tax render has passed initial screens by the IRS covering rudimentary fraud checks, verifying your SSN and ensuring no obvious red flags on your return.

Your taxation return will remain in this status while the IRS processes information technology in more item to ensure it is compliant and the refund amount is accurate.

Your refund tin remain in the status for a while if it is circuitous or the IRS feels farther information is needed. The IRS is however saying information technology processes most returns in 21 days if your return is not flagged for farther review.

There is no demand to follow-up with the IRS if the WMR tool shows the status of Render Received. If this status is showing, the IRS is processing your return and further calls or letters won't speed upward the process.

At that place is also no status of "under review" and then sometimes your status may be stuck in this status (or fifty-fifty disappear as discussed below) while the IRS completes its reviews

WMR Status Bar ii: Refund Approved

This status will announced if your taxation render checks out and and your return has been approved for payout by direct deposit or bank check. A personalized refund date will be provided and the WMR condition will at present be Refund Approved. If you elected the straight deposit (DD) option for your refund, you lot volition get a date past which it should be credited to your account.

While the IRS does hope that it will process most returns in under 21 days, it could take longer if complications come. This delay is what frustrates most taxation payers equally the IRS does at times provide limited information if errors in your return are spotted.

While some information is provided on WMR and IRS2Go, the IRS will generally mail you for farther detailed information. You can also check your IRS taxation transcript for details. This could add days, weeks and even months if lots of additional information is demand. So ensure your taxation return is as accurate when filing.

WMR Status Bar three: Refund Sent

As the proper name implies means the IRS has sent your refund to your nominated bank account(south). It will give you a specific date the refund was sent. Direct Deposit payment are generally processed within 5 days. I.e. the money will be in your depository financial institution available for withdrawal inside five days of the refund sent date.

Y'all should only contact your bank or financial institution if you lot have not received your render after 5 days of the IRS refund sent date.

Note that you lot may get another message below the refund deposit/credit details saying your refund was reduced or offset (as discussed in the sections beneath). You will get a tax code notice for why this happened and options to entreatment. Just the IRS volition withal send y'all what they have deemed approved.

If y'all requested a paper check this means your check has been mailed and could take 10+ days for you to receive this via mail. It could take weeks or months if your mailing address is outside the United states.

When do IRS2Go/WMR & Transcript Get Updated For Revenue enhancement Return and Refund Processing?

The WMR website and IRS2Go mobile app tin update any day of the week. Withal, major updates on daily accounts are commonlyWednesday; and major updates on weekly accounts are usuallySabbatum.

You can see if your IRS business relationship is daily or weekly in this article. This will by and large show which batch or cycle your return and refund (if applicative) is beingness processed in the IRS chief file (International monetary fund). The IRS has older systems and does most of its processing in "batches" or "cycles."

So knowing which ane y'all are in can given you some guidance on where your return processing and WMR/IRS2Go updates are probable to happen.

WMR and IRS2Go are nonetheless down for scheduled system maintenance on Dominicus and Mon nights per the screenshot below. Yet during the elevation of revenue enhancement season information technology is not uncommon to see longer outages.

Further when besides many users are on or attempting to admission the refund trackers, the IRS tin can restrict admission to these tools and people sometimes come across the message that system cannot verify their identity. They may too see missing condition bars considering of this, as discussed in the next section beneath.

IRS batch processing more often than not takes place 12am to 3am (EST) and refund direct deposit processing takes 3:30am to six:00am (EST) – most nights, look Sundays.

Similar to WMR and IRS2Go your gratis IRS Tax transcript can get update any solar day of the calendar week. Notwithstanding, major updates on daily account are mostly on Tuesdays; and mass updates on weekly accounts are unremarkably on Fridays. This lines upwardly with the cycle codes as discussed in this video.

Assist! My WMR status bars have disappeared

Per the IRS, the WMR tracker graphic may disappear or not exist shown if your return is yet processing (TC 152) or falls nether IRS review after it is received (Condition Bar 1: Return Received) because additional information is needed for your return.

The IRS still has your render merely things are essentially on hold until the IRS gets the additional information from you to continue processing your render .

You lot will either get directions on WMR or IRS2Go or the IRS will provide contact information. Follow the provided instructions and return whatever boosted information ASAP to get your potential refund and reduce any farther delays.

An explanation or instructions (come across IRS Tax or error codes) may be provided on your transcript, ahead of WMR/IRS 2Go updating in some instance. This can happen even if you previously checked WMR and it showed the status as "Return Received."

However it is not uncommon to also have "Northward/A" on your transcript and run into no or disappearing bars on WMR/IRS2Go. In this case you will only demand to expect for IRS to finish their processing.

Talk to your accountant, tax advocate or tax professional if you lot are not articulate on what the IRS is asking for.

How far dorsum does the WMR tool become for checking my refund status?

The IRS recently made enhancements to the Where is My Refund tool (and IRS2Go mobile application) that allows taxpayers to cheque the status of their refund for the current tax twelvemonth and 2 previous years. This is helpful for tax payers still waiting on by year tax returns to exist processed.

Originally it was simply express to the refund processing condition of the current tax year, with tax transcripts existence the source for prior years.

Tax filers volition need their SSN or ITIN, filing condition and expected refund corporeality from the original filed tax return

for the revenue enhancement year they're checking.

Notation that this multi-year status checking enhancement is merely for the online WMR tool. Those calling the refund hotline are still limited to inquiring about the current year'south revenue enhancement render.

Why is my Refund Status Showing a Reduced Refund Message (Lawmaking 203 or 570)

One thing many revenue enhancement payers come across during their taxation refund processing is a message that that refund has been approved for direct deposit (WMR status = Refund Sent), simply that it has been reduced, per the screenshot beneath.

This message only means your refund has been garnished or reduced for a government (BFS) adamant reason (tax offset). This is generally because you owe money to the federal government considering of a delinquent debt – e.g. overpaid unemployment, unpaid past year taxation obligations etc.

Your render tin as well be held upward and reduced if you run into Tax Code 570 on your transcript. This code ways your return is on hold due due to additional verification which may or may not have a monetary impact. No further processing or refund payment can exist made until this hold is lifted following additional IRS processing.

You can see more than in this commodity or video, but you would have received a letter advising of y'all of the reason and you can call or file an appeal (via BFS) to claim back any deducted refund amounts.

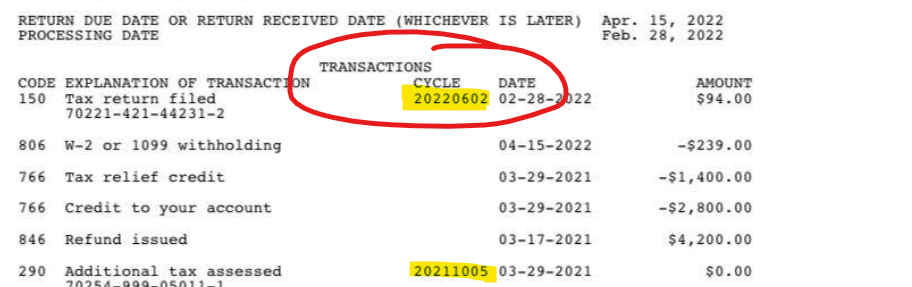

Using my IRS Transcript and Cycle lawmaking to get more details on refund processing status

The lack of progress or details in the WMR or IRS2Go app has made some tax filers utilise their IRS tax transcript (costless from your IRS account) to go more details on their return/refund processing condition. Your transcript which shows various tax processing codes and a "cycle code."

This is an eight digit number that indicates when your tax return posted to the IRS Chief File (IMF). The cycle code is updated regularly and when combined with the tax topic code, can provide insight into your revenue enhancement refund condition, processing stages and potential direct eolith date. You can see a deeper word in this article.

Reader Feedback on IRS Delays (with some help)

Here a sampling of some comments and responses from readers of this site on this topic and WMR refund status/processing:

(From Dorothy) Nosotros wait and look all year long and so bam we file we become a big refund and we are told 10 to 21 days and what exercise we do. We sit here looking at our refund tracker nosotros log on to WMR site and we check wmr2go we but continue watching and waiting for our Money.

And then simply when we are not looking something changes meaning our bars move and we check our accounts and in that location'south our Money. But here'south what bugs me the nearly. The IRS is looking at us and sees we owe them and mode before we go notice or told what to practice next.

They are saying Now you must pay. What if we made them WAIT. Or when a alphabetic character comes nosotros send it dorsum with a response we volition get back to you in 5 to x days. Wonder what they would think. Just here'due south for all of us ITS OUR MONEY AND WE Want It At present

_____________________________

(From Brandi on her WMR feel) To those who accept been told that your returns are under review I due east-filed on January 5th last twelvemonth but of grade it wasn't sent to IRS until Jan 20th (when IRS starts accepting returns). It was accustomed the next day.

My confined on WMR disappeared after about about a week and have not reappeared since. I was informed on 2/ten that my return went nether review on 2/two and to expect information technology in half dozen-8 weeks. On 2/24 I received a [IRS] letter stating that I needed to verify my identity before my return could exist processed farther. I called and sat on hold for 1hr 45 min earlier talking to a person.

I verified my name, social security number, birthdate, address, fathers name, kid's birthdate, child's social security number and the full amount of my return. By the way, none of my personal info has changed in the last 10 years. I was then told that my return would now exist returned to the processing department to be completed and to expect it within vi weeks from that mean solar day.

Yes, 6 more weeks from the date i verified my information. Unless at that place is some other problem, and so i volition be contacted by post to provide whatever else is needed. This was the worse case scenario she said but was preparing me but in case. I uncertainty it will be vi more weeks or that they will need anything else but I am so upset that I have been waiting since Jan 20th and it took over ane month merely to receive a letter to verify info that has not changed in over 10 years.

Now I'yard waiting 6 more weeks for my money. I know anybody's situation is dissimilar but if you have been waiting a while or were told yours is nether review or you lot demand to do identity verification, this is possibly what you could wait to happen with your return.

Bottom line merely don't depend on the IRS to exist fast this year. Some are getting their returns quick and then there are some like myself that will be waiting much longer!

_____________________________

(From Mary Elizabeth) I empathize that this is a stressful situation. My own bars had disappeared for six days now while I was accepted on the 21st. I am due a refund according to Turbotax by 2/11. The number and extension provided below has personally helped me through my own tax problems, as well as my friends and loved ones; while the full general or mutual number gives millions of people the "automated phonation" and "runaround".

If someone to achieve a real person in the IRS role, do the following:

1) First, make sure the time is at 7amEST in the morning time. (Annotation: this is the perfect fourth dimension to achieve someone to avoid LONG wait times!)

2) Phone call i-800-829-0582 and press extension 633 (Don't worry, this department is the quickest and will nonetheless inquiry your situation to give yous a definite reply)

3) Expert Luck

Some of these examples are probable what y'all are facing then hopefully the answers here tin can help yous. Please leave a comment below if you need more feedback or want to share your experience.

YouTube Videos on IRS Refund Processing Delays

- No Revenue enhancement Refund After 21 days? Reasons Why and Tips on Contacting the IRS

- IRS Refund Status Timing & Disappearing WMR/IRS2GO Confined + Why Your REFUND Mayhap Lower Than Expected

- When Will I Become My Tax Refund ? IRS Refund Processing Schedule and Top 3 Reasons For Delays

Useful IRS numbers for refund questions

| Some useful IRS Telephone Numbers to Get More than Information on Your Return and/or Refund | |

|---|---|

| Talk To a Live Person (800) 829-0582 Ext. 652 Taxation Help Line Refund Hotline TeleTax | Taxpayer Advocate Service Hotline ane-877-777-4778 Turbo Tax Customer Service Line H&R Block Customer Service Line |

Subscribe via email or follow us on Facebook, Twitter or YouTube to get the latest news and updates

Source: https://savingtoinvest.com/wmr-and-irs2go-status-differences-return-received-accepted-or-under-review-and-refund-approved-versus-refund-sent/#:~:text=The%20WMR%20website%20and%20IRS2Go,weekly%20accounts%20are%20usually%20Saturday.

Posted by: perkinshathand.blogspot.com

0 Response to "What Days Does Wmr Update 2018"

Post a Comment